10 How can i Pay with your Smartphone

Content

Best of all, this method enables you to spend folks regardless of whether they’lso are people at your lender. If you want to purchase while you travel otherwise store worldwide on line, you could be best off having a wise account and credit. You could potentially hold and you can perform dozens of currencies inside your membership – the from the smartphone – making bodily and you will mobile costs along with your connected card. Go shopping together with your debit credit, and you will lender away from almost anywhere because of the cellular telephone, pill or computer system and most 15,100000 ATMs and you can 5,one hundred thousand branches. We’ve secure your options if you wish to make use of your cell phone within the a physical shop. But what for many who simply want to repay your buddy for supper, or settle the brand new cable supply bill with your roommates?

If you are paying on the web rather than composing a check, the percentage try canned rapidly. You can end occur to paying the bucks for the percentage prior to a check try removed. You always can be create recurring payments from electricity, local rental, or loan company. Extremely enterprises provide the accessibility to signing up for an automated draft otherwise scheduled percentage. It’s always best to create an automatic write just with expenses which might be constantly a similar monthly. Set up automated costs for the bills that are a great put matter each month.

Initial launched in the uk by Barclaycard within the 2007, contactless payments has rocketed within the last 17 decades. As much as a 3rd of the many repayments in the united kingdom are now contactless, based on Uk Fund, with 87 per cent men and women to make contactless repayments at least monthly. Towards the end of last year, contactless costs taken into account 63 % of all credit card and you will 75 % of the many debit credit purchases.

Merely down load the newest application, register making use of your PayPal account information otherwise set up a the fresh account, and faucet “Available” to the household screen. While it’s getting more wide-spread each day, not all stores accept cellular purses. The brand new app is free of charge to use and just must be linked to their debit or bank card.

Simple tips to Post and you may Perform Payment Desires

If the mobile phone is missing or stolen, immediately cut off your own notes regarding the application and contact their bank. Use the area otherwise secluded rub features (Find My iphone, Bing Discover My Tool) to guard yours and you can financial study. For profiles trying to find self-reliance, particular applications will let you add commitment notes, organize expenditures from the category, and even take off notes which have you to click once they find a great skeptical purchase. We believe blessed as invited on the the members’ companies, and we try and give personal provider and you will personal collaboration while in the your project.

- There is certainly which application pre-attached to all the Fruit’s recent issues (which range from new iphone six and soon after), the new cell phones is provided which have NFC technology.

- If you would like rating an upgrade out of dated bucks and you can cards nevertheless’lso are unacquainted software-centered payments, be aware that it’s as well as simpler to score set up than you might believe.

- While you are playing with a third-party services, the process for establishing money would be comparable.

- Notice that last round point — this is where the portable services is available in.

Most financial help to own investing costs is provided from the function from subsidies to have particular expenditures instead of inside the dollars. Yet not, you might be eligible for interests assist with render dollars service. If you possibly could’t shell out credit cards expenses, ask your credit card team if they can give you a break for the commission conditions. When you can have demostrated an intention to pay, they could give you more hours, all the way down an installment, or waive a charge. Underneath the Sensible Care Operate, medical insurance marketplaces are built in the per state to help people evaluate additional medical health insurance possibilities. These markets allows you to discover very costs-productive insurance rates for your requirements.

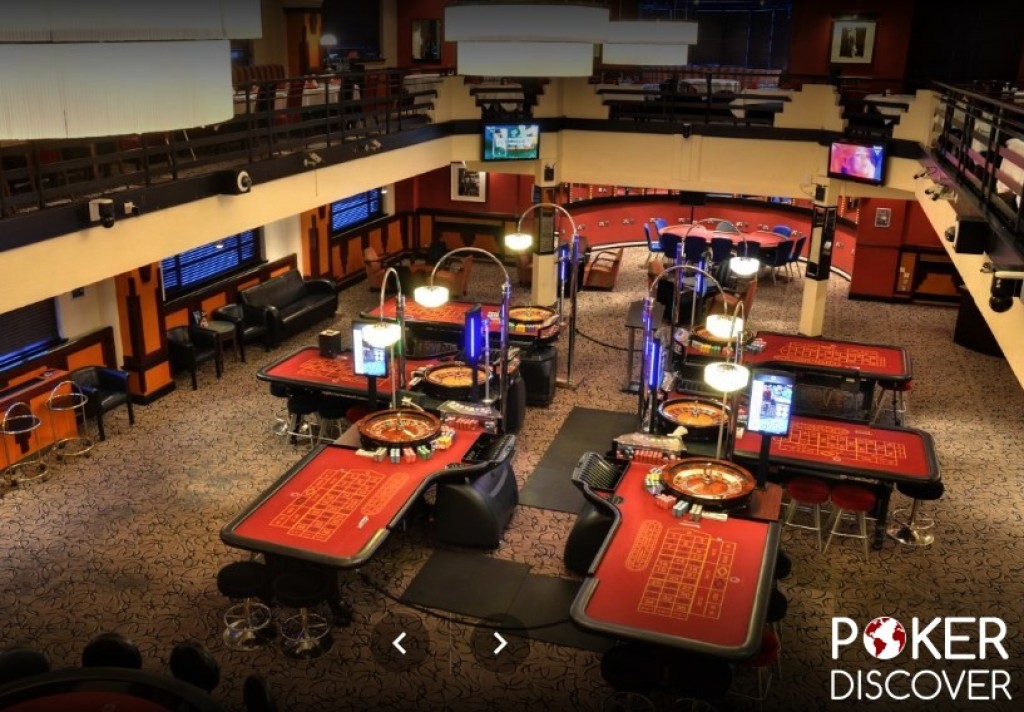

Here, I’ll stress https://mrbetlogin.com/playn-go/ among the better possibilities to pay By Cellular telephone. These offers get back a share of your casino losings returning to participants because the added bonus finance. For example, the new gambling enterprise will keep monitoring of the web losses each week or day and can make you a specific percentage right back as the a casino incentive. At the same time, specific incentives wear’t require any type of deposit to allege.

Deposit services associated services are supplied by JPMorgan Pursue Bank, N.A great. Member FDIC. Pursue on the internet lets you manage your Pursue membership, consider statements, display interest, pay the bills otherwise transfer finance safely from main place. To own inquiries otherwise issues, please contact Chase support service otherwise tell us regarding the Pursue issues and you can feedback. Look at the Pursue Community Reinvestment Operate Social Apply for the financial institution’s most recent CRA get or any other CRA-associated suggestions. To buy something on the web, visit your shopping cart application to see the new Apple Spend, Bing Spend or any other involved payment symbol and select it as your own commission strategy.

Even though you are set, something such as expanded unemployment, a primary infection, or a demise regarding the family members can simply fatigue everything you have. Healthwell Basis links the brand new gap between what wellness insurancepays and the cost of therapy and you may medication. They can assistance with medical insurance premium, deductibles, treatment co-will pay, travel costs, and you may out-of-wallet expenses. The fresh Extra Nourishment Assistance System (SNAP) provides positive points to let reduced-income household increase the amount of healthy dishes on their shopping list. Snap professionals are available to candidates one to satisfy particular earnings and you may works criteria and certainly will be applied to have on the web.

When you fund a phone, the price of the computer is actually spread over along the fresh offer, and this contributes to their payment per month. If you are willing to explore a mature design, you could conserve somewhat in your invoice. To create it up, unlock the brand new Observe software, tap My personal View and pick Wallet & Apple Pay.

Which place Samsung Pay since the finest to possess Android os profiles with 10 million pages over Android Spend inside 2017 alone. Since that time Apple shined a white for the mobile payments inside 2014 and that idea continues development and getting larger, with a brand new cellular fee application and find out every day. Finding the optimum credit for this purpose isn’t really always easy as the pair individual playing cards offer an explicit rewards group, and smartphone expenses. Amazingly, business playing cards have a tendency to offer the greatest benefits for investing come across monthly bills such mobile phone services.

Medical health insurance Marketplaces

You’ll score verification of your pick right on their device, and you can head out of the store without contemplating beginning your bag. Many of us did, while the debit cards caused it to be very easy to fund anything without needing an excellent fistful out of papers costs. And debit cards generated cash a good relic away from ages gone by, cellphones are in fact doing a similar to help you synthetic. From the inside the newest application you can view your account harmony, monitor your playing cards, deposit checks by using a picture, set up alerts and also have the new position in your credit score. Once you have additional a fees method inside the Twitter you are ready to store, make a contribution otherwise publish currency to a person with a myspace account and a connected debit cards.

Apple Shell out

If you wear’t have to are an attached invoice, just express the newest invoice amount—or any type of details a customer must spend their bill online—in the human body of the text message. In this guide plus the brand new wild, you’ll discover text message-to-shell out also known as “Text messages repayments,” “Text messages expenses shell out,” “spend from the text message,” “Texts selections,” or any other differences. Get together money because of the text message is one of the surest a means to increase income and construct greatest customers experience. SoFi Checking and you will Savings is a great membership option for individuals who never notice maintaining your discounts and you can checking in a single account. Having online bill shell out, you will not need to bother about send waits otherwise somebody stealing your look at.

Rather than NFC in your cell phone, you’ll not be able to generate contactless payments in stores, even though there are also mobile percentage choices you to we will discuss later. You just use your cellular telephone’s cam to add your support or present notes too while the handmade cards. Once they’lso are stacked, you can check out nearly everywhere credit or debit notes is actually accepted. For those who connect Venmo along with your debit cards or savings account, all of the transmits are completely totally free. That have a charge card there’s a 3% fee to send currency in order to relatives and buddies (choosing is free of charge), but not one to fee are waived once you buy from a corporate. Understanding how to make use of their mastercard on your cellular phone is generate searching more convenient and keep maintaining you from being required to build connection with the newest credit terminal.