Understanding Risk Disclosure for PrimeXBT

Understanding Risk Disclosure for PrimeXBT

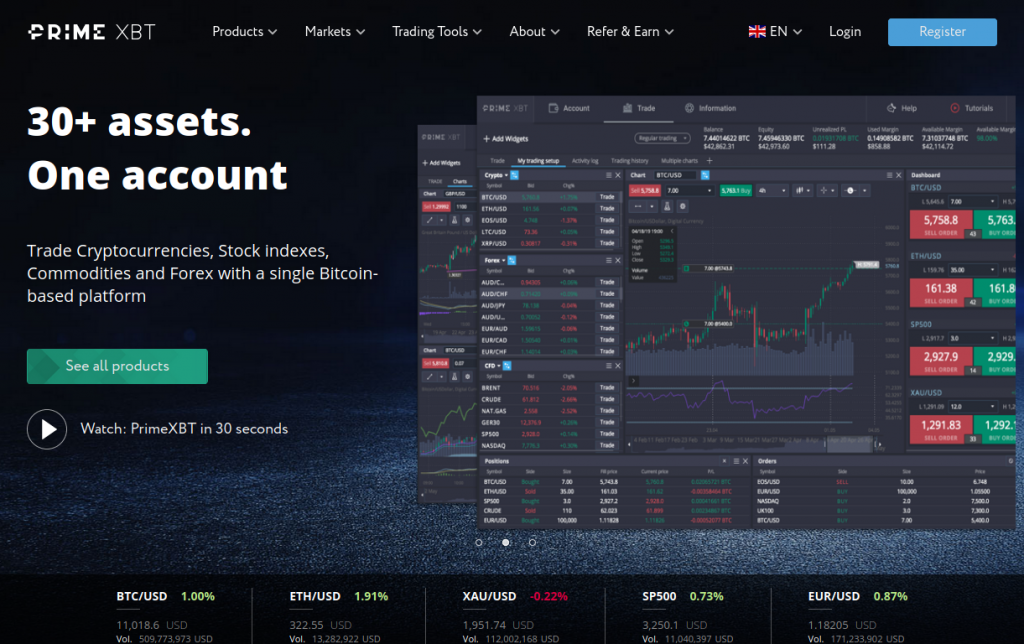

In the world of cryptocurrency and leveraged trading, risk disclosure is an essential aspect that every trader should understand. PrimeXBT, a leading trading platform, emphasizes the importance of awareness regarding the risks involved in trading. For detailed information, refer to the Risk Disclosure for PrimeXBT PrimeXBT risk disclosure page.

The financial markets are inherently volatile, and trading cryptocurrencies can amplify that volatility. This article aims to unpack the concept of risk disclosure specifically for PrimeXBT, highlighting the nature of the risks involved, the significance of understanding these risks, and tips on how to navigate the trading landscape effectively.

What is Risk Disclosure?

Risk disclosure is a legal document that outlines the risks associated with trading certain financial products. It serves to inform traders about the potential pitfalls of engaging in trading activities and ensures that they have a comprehensive understanding of what they are getting into. For platforms like PrimeXBT, risk disclosure is critical because it helps foster a transparent trading environment.

The Nature of Risks in Cryptocurrency Trading

When trading on PrimeXBT or any other platform, traders must be aware of various types of risks, including:

1. Market Risk

Market risk refers to the potential losses that traders may incur due to unfavorable price movements. The cryptocurrency market is notoriously volatile, which can lead to sudden price fluctuations. These price changes can be aggressive, leading to significant gains or losses often within a short time frame.

2. Leverage Risk

PrimeXBT allows for leveraged trading, meaning traders can borrow money to increase their positions. While leverage can amplify gains, it can equally magnify losses, leading to a greater risk of losing more than the initial investment. Understanding leverage dynamics is critical for managing risk effectively.

3. Liquidity Risk

Liquidity risk is the risk that traders may not be able to execute transactions at the desired price due to insufficient market activity. Low liquidity can lead to slippage, where a trader ends up buying or selling at a worse price than expected, potentially resulting in unintended losses.

4. Regulatory Risk

The regulatory landscape for cryptocurrencies is continually evolving. Changes in regulations or the imposition of new laws could affect the operations of trading platforms like PrimeXBT. Traders should be aware of how regulations in their jurisdiction may impact their trading activities.

Why is Risk Disclosure Important?

Risk disclosure is crucial for several reasons:

1. Informed Decisions

It enables traders to make informed decisions about their trades. When traders understand the risks involved, they can better assess whether they are willing to take those risks.

2. Protection Against Losses

By understanding the risks, traders can implement strategies to protect their investments. This includes setting stop-loss orders, diversifying their portfolios, and using risk management tools available on PrimeXBT.

3. Compliance and Accountability

Risk disclosure aligns with regulatory requirements, ensuring that platforms like PrimeXBT comply with financial regulations. It fosters trust in the platform while holding both traders and the exchange accountable.

Tips for Navigating Risks on PrimeXBT

To manage risks effectively on PrimeXBT, consider the following tips:

1. Conduct Thorough Research

Before entering any trade, it’s essential to conduct thorough research on market conditions. Understanding the assets you are trading, their historical performance, and current market trends can help mitigate risk.

2. Utilize Stop-Loss Orders

Setting stop-loss orders is a crucial strategy that can protect traders from significant losses. A stop-loss order will trigger a sale when the price of an asset falls to a predetermined level.

3. Start Small and Scale Up

New traders are often advised to start with smaller investments and scale up once they become more comfortable with the trading environment. This approach allows for learning and understanding risk levels without exposing oneself to significant losses.

4. Monitor Market Signals

Being aware of market signals and indicators can help traders react promptly to price movements. Tools and features offered by PrimeXBT can assist in tracking market performance.

5. Continuous Education

The financial market is dynamic, and continuous education is vital. Traders should seek out resources, webinars, and training to enhance their trading skills and risk management capabilities.

Conclusion

Risk disclosure is an indispensable part of trading on PrimeXBT. Understanding the inherent risks and adopting appropriate strategies can lead to more informed decision-making and potentially more successful trading experiences. By prioritizing education and risk awareness, traders can navigate the exciting yet volatile world of cryptocurrencies with greater confidence.